by Mrs. Xennial

As promised, here I am creating a overview (also for my reference, too). It is always taken as the first step in personal finance or budgeting: know where you money goes. I know mine probably has fallen into the common folks’ style, where housing is the biggest take of all expenses, and everything else we budget when/what we can. However, with our house finally closed (YAYYY), I’m not gonna lie: I’m eyeballing a lot of purchases that probably aren’t need-based.

And as xennial as I am, although I embrace technology, I’m old school in budgeting (which I may have to upgrade eventually so I can do an annual review). I would write down a bi-monthly budgeting breakdown on a notebook, and usually plan a little ahead before each paycheck hits. I also track our monthly grocery bills, even though that’s more out of Mr. Xennial’s budget.

Here’s the breakdown from that page, for the second paycheck in April:

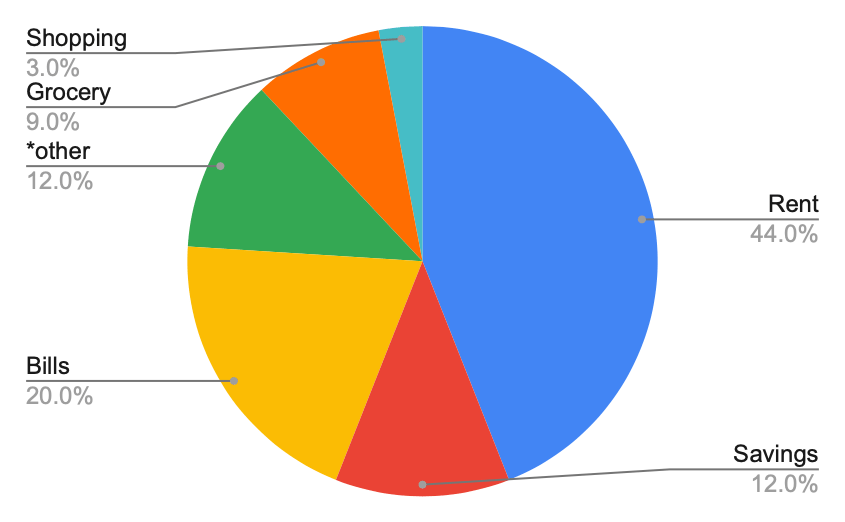

Here’s the breakdown on my end, once every two weeks paycheck layout. And here’s a further breakdown:

- Housing 44%: Not surprisingly, rent was a huge part of my budget. Even at our shitty 1-bdrm apartment, our rent is slightly higher because we have to “pay rent for the furry kids,” too. I have no regret considering we have so many, and we needed a place to move into stat, but man, my neighbors upstairs and next-door is MORE THAN WE WOULD LIKE TO BEAR.

- Savings 24%: One thing I want to further explain is that I would consider my real savings right now at 24%. 12% of those goes to my CIT saving account (our emergency fund account), which is getting 1.7% monthly at the moment (still not much, but it’s pretty good comparatively). The other 12% is a premium (categorized as *other) for an Indexed Universal Life, which is going through underwriting process right now. I’m hoping this provides more peace of mind regarding retirement and accidental life protection.

- Bills 20%: Honestly, it’s not quite fair to make it sounds like this is all bills. Let me explain. I set aside 20% of my take-home pay to handle our necessary bills. This amount is set aside in an account separately, with a $0.1 reward for every debit purchase as benefit, to pay for utilities and other stuff (including doctor visits, and whatever I categorize as “necessary”). Whatever that is left not used will be kept there in order to save up for car insurance (I have enjoyed paying off 6 months at a time just to get it out of the way) and registration costs. Right now, there is still 50-51% of that 20% remaining in anticipation of those upcoming bills.

- Grocery 9%: Even though grocery usually comes out of Mr. Xennial’s paychecks, it almost isn’t feasible to also add on a semi-monthly trip to Costco, which at times gets a little out of control. (I admit, without Target, Ross, and TJ Maxx atm, there’s only so many places I can walk in with 1 thing on the list and come out with 10 instead). So this 9% doesn’t necessary always pop up on my budget, and only shows up when we decided to make the trip. During this last trip, we had also “down graded” our membership since we don’t go there often enough for the now $120 Executive membership. We decided to keep the regular $60 membership and re-evaluate the necessity of it by next renewal.

- Shopping 3%: This is sort of my fun money. Some of this was ordering take-out (for the first time since the lockdown), a bubble tea (my guilty pleasure once in a while, and knowing they do take-out isn’t helping my waist line). Also, I used part of this to buy adult coloring books because I need some distressing/me-time activities according to my therapist. This category fluctuates a little depending on what the evil online algorithm tells me what’s on sale. Say, for example, I actually bought a pair of Timberlake’s leather boots during last paycheck because my cheap pair is hurting my feet (and are not waterproof).

I chose to do this paycheck review because I generally pay my car loan with the first paycheck of the month; but since we have gotten our money from the sale of our house, I have contacted the bank to do a pay-out, which hopefully will be processed in less than 10 days. If that’s the case, this above chart will hopefully be the norm until we *hopefully* find a new place by the end of the lease. By then, it’d be “goodbye rent, hello mortgage payment.” I’m hoping that I have learned enough to NOT ever be house-poor again, and that our monthly payment will not be much more than what we are setting aside for rent now.

Another thing I would love to do is to combine Mr. Xennial’s budget (which he doesn’t do), so I can do a “household” percentage review. I think that would give me (and perhaps you, the readers) a better view of where our money goes as a family. I’ll have to see what I can do… fingers crossed.

Short-term Goals:

- I’m hoping to keep the random shopping to the minimum and focus more on what we need versus what we want.

- I’m hoping to keep looking at other investment opportunities and perhaps up my coverage for IUL since it is tax-free investment with pretty good return. (Send me a DM or message me on my Insta if you want to know more.)

- I’m going to start a Roth IRA (yes, shocker, we don’t have one still yet) with our stimulus money.

- Make some extra money with my side-hustle.

Long(er)-term Goals:

- Find a property that doesn’t make us house-poor and also has potential for rental income.

- Fix whatever needed for the property to live comfortably and rent part of it out.

- For 2020, I would love to at least hit 50% household savings between both Mr. Xennial and me, with eggs in different baskets, of course.

That’s it for now. Mrs. X out.

Leave a comment