by Mrs. Xennial

Happy new year fellow FI-minded people! My new job gave me 2 weeks of PTO for the holidays, and after we resume work, we got busy… hence the delay in the 2022 overview. One thing I learned from 2020 and 2021, is that every time I mentioned my anxiety towards money, I always ended up solving my own issues. Why? Because I know if I can plan ahead, the anxiety lowers dramatically. Sure, 2020 and 2021 being a colossal mess, I’m sure there were times I accidentally dug into our savings to cover some things. And honestly, I can’t say that the 2022 prediction would be so good that I follow it to a tee. That is the hope, but we all know that life can hit you in the face unexpectedly. (And thus the importance of having your emergency fund ready for any situation!)

If you saw my last few posts, you’d know that I have taken a new job offer, which caused a pay cut, and Mr. Xennial and I had to figure some things out (primarily regarding health insurance) to make it work for the both of us. I should also say that this pay cut, while it may seem like a step back for my FI journey, is important for my mental health. So far, I fully enjoy working with the team and my boss, and her setting the boundary on turning off work completely when we are off definitely is very helpful for myself, too.

So, with the pay cut, one thing I know for sure is that I lost the 401K match that I used to get from the government job when I start (which would resume after I’m done with my 90-day trial period, and it’d be at 3%, I believe). While my starting pay is lower, initially at the acceptance call I had with my boss, we’ve also discussed about a conversation regarding pay raise as soon as 90-day trial is coming to an end. I’m confident that I could discuss a pay raise when that rolls around, and whatever I plan right now would then stick to the same, and I’d spend my money as if I’d never gotten the raise, and save all additional income (either put it back to replenish our emergency fund, housing emergency fund, or plain and simple started to either put in Traditional IRA or invest in index fund).

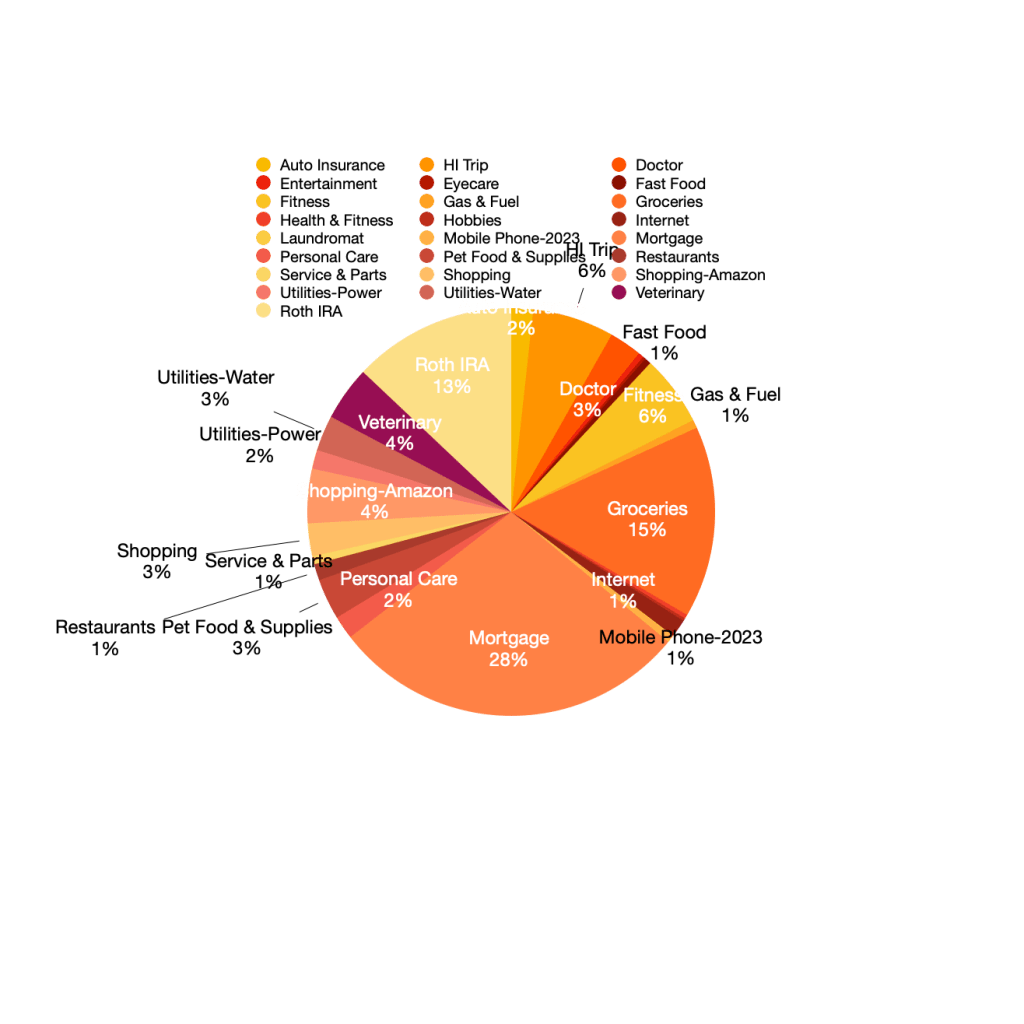

Since that is not going to happen til middle of Q1, let’s focus on the first part: spending my money with current income, and here’s a breakdown for my annual pay (which is a little messy; bear with me):

Honestly, after initial assessment, I knew I do this WAYYYYY too complicated for my own good; allow me to explain a little: This is mainly a visual for myself to see the percentage that I’d spend in each category, particularly the necessities. One thing that traumatized us badly was that we were house poor in Hawaii. We were obviously paying at 50% if not more (50% is with a roommate, no less) just for housing alone. If one of us was a high earner, and my 50% means he’s paying more in other categories? Maybe. But we were both consistently paying 50% or more throughout the time we had the house there. So knowing my share of mortgage payment here in Washington is estimated at 28%, this brings a bit of peace of mind for sure.

(Note: Mortgage at 28% is also me adding additional payment towards principle, not just the monthly billed amount. We are not doubling down on payment at the moment, but paying a bit more is just our goal regarding our mortgage. Once we have our rental unit ready, the hope is to put most of the rent we collect towards our mortgage payment and save a little towards the maintenance of the unit each month.)

Now, is this annual analysis absolutely correct? Not at all. Actually, my smart ass just estimated the spending; and by the time I calculated my take-home pay (according to current pay without pay raise), I quickly noticed that my estimated spending is about $4k over my take-home pay.

Did I hyperventilate a little? Maybe.

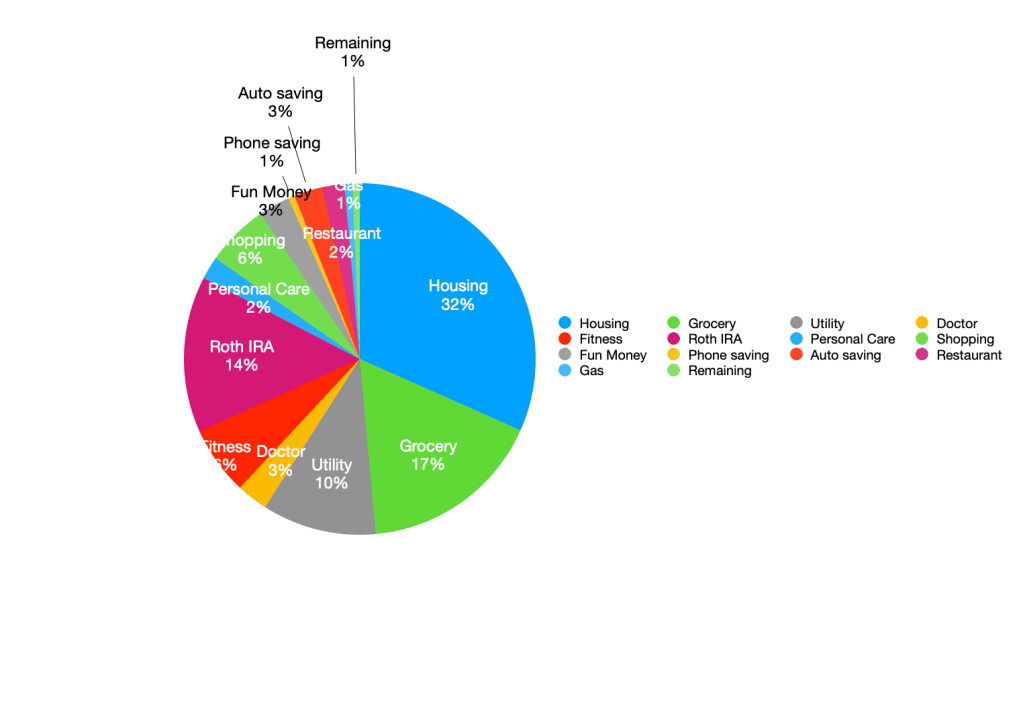

But again, advanced planning is the key to battle my anxiety, so after I had several meetings with the All FIRE Connect! group on Meet Up (love these folks to pieces, really), an end-of-the-year budget workshop from The Financial Diet, and a few Choose FI Podcast episodes… I thought “heck, let’s simplify this with breaking down the monthly expenses for each month of my take-home pay:

Housing, utility (water, electricity, and internet), and grocery shopping (including grocery for Xennial Canine and Felines) are still the larger percentage; but savings (Roth IRA) also remains to be crucial to me. I maxed it out in 2021, and that brought me nerdy joy, and I plan to do the same this year. Another few things I refuse to cut would be fitness (1x/week physical training) and personal care as I’ve come to a conclusion that my physical health is also important for my mental health. Also note that I have set aside some savings for my car (either for insurance or maintenance), and for my phone (annual, basic plan for Mint Mobile is only around $200 or so; not the best in everything but definitely enough for me #notaffiliated). And holy crap I have “remaining” category? That will be either savings towards a potential reunion trip to Hawaii, or simply invest in one way or another (if I don’t have accidental spending that eats into that category, that is).

My mindful goals for 2022 budgeting also includes the following things:

- Tracking: In addition to this monthly overview, I’m adding another app on my phone to track my spending. Currently, I’m using EveryDollar app (free version, of course), and the main reason I use is because I could input my estimated spending categories, and it allows me to see what the remaining amount I have in each category after each input. I also plan to do a quarterly spending review, and see if I have the amount I plan to save (and then some) is set aside in the allocated account(s). Not to be harsh on myself, but this is something I want to do (and that I’ve never done previously) to see where I’m at and how am I doing so far.

- Grocery: I’d like to spend more wisely on our grocery, especially now we see the increase in many everyday items in the store. By “wisely,” I mean to be more attentive to sales and coupons that happens in stores (our favorite go-tos include Grocery Outlet and Safeway), and in apps (my go-to cash back app is iBotta at the moment). Also to be more intentional with the way we approach food, and be creative with what we have at home. And definitely be mindful of the leftovers, and make sure those are not wasted and “growing things” in the fridge.

- Shopping: I want to be really mindful to sense the NEED vs. WANT again. One category I tend to be more relaxed in 2021 is definitely the shopping front, and it isn’t 100% helpful to be an Amazon Prime member. (Look ma! One click purchase!) The line of need vs. want was very blurred sometimes, and I want to be more conscientious about each decision before each purchase. Also maybe thrift more; if I can find a good conditioned anything in a thrift store, I’d like to get those instead of getting new things every chance I get (also for the sake of environment).

- Fun: I’m also adding “Fun Money” to the budget. I want to explore more artsy hobbies this year, and hope to find one that also brings me joy (and hopefully budget friendly, too…wish me luck). This would also include a budget for restaurant, whether that be for that once or twice a month of “I just don’t want to cook, someone send food to me right now please” moments, or this could be for the once a month nice sit-down dinner with Mr. Xennial, too. I think I’m at the point where I need to be able to enjoy life while we are on this FI journey. If there’s no fun, this journey would be much harder.

Finally, I plan to give myself some grace and patience as I continue on this journey to FI (which I hope you are, too). Like I mentioned, there will be times where life just slaps you in the face, and the whole point of this practice isn’t to give myself a hard time if I don’t follow through. The whole point is to try my best to stick to it, and review periodically to see how I can improve if I mess up a little.

Let’s do this, y’all!

ps, if you have any artsy yet budget-friendly hobby suggestions or just suggestions in general, pop that in comments, pretty please!

Leave a comment